FX Risk Management

Using systematic hedge funds models we help you manage FX risk in your portfolio. The goal is to actively manage a risk exposure you already have and generate an incremental return.

We offer dynamic currency management tailored “as-a-service” to your international portfolio. Our goal is to turn your currency risk into a return opportunity. Systematic strategies à-la-Sanostro use trading signals generated by our quantitative fund partners to optimize your currency positions. This approach is operationally simple, cost-effective and can implement any currency restrictions and benchmarks. The models behind the trading signals are always on the watch and dynamically adjust your currency positions in order to benefit from behavioral patterns, structural imbalances and macro cycles. You profit from the FX market insights of the best quantitative managers.

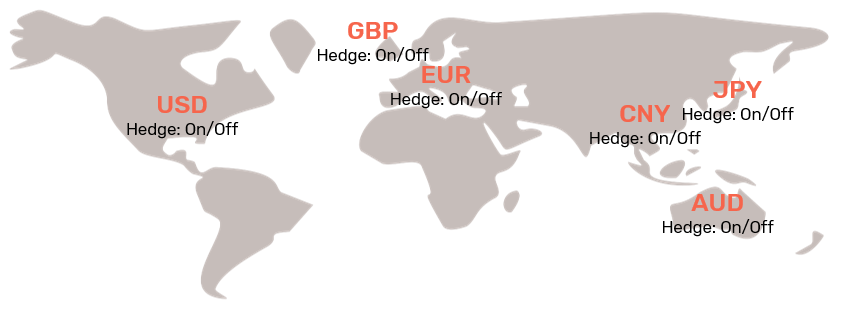

Combine your FX exposure with systematic dynamic FX hedging

For investors with international FX exposure and in need of a systematic approach to managing this risk.

Benefits

- Cost-effective, disciplined and robust FX management

- Source of uncorrelated returns

- Alternative way to access hedge fund intelligence

- Increased return and Sharpe Ratio

- Can be implemented with a focus to reduce risk or enhance returns

Potential drawback

- Can temporarily lead to increased currency exposure