Equity Downside Protection

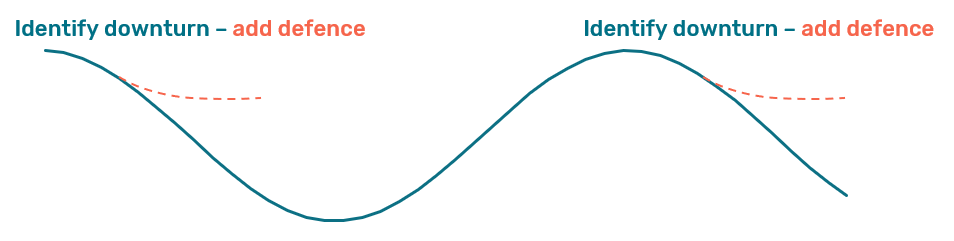

Using systematic hedge fund models we help you dynamically align equity market exposure to changing risk environments. The goal is to help you stay invested while having a defense in place that will help you mitigate downside risk.

Reliable risk management requires consistent judgement of complex data. We offer permanently installed, rule-based downside management that can be added and tailored “as-a-service” to your investment strategy. The goal is to reduce drawdowns while minimizing the impact on returns. Your investment always keeps your strategic focus but dynamically adjusts market exposure based on the trading signals generated by our quantitative fund partners. The models generating the signals identify behavioral changes in trends as markets shift from a stable to a flight and fear-driven environment.

Combine your equity exposure with systematic exposure management

For investors who believe in equity as a main driver of returns, but are worried about the stability of the current bull market.

Benefits

- Intelligence from top quantitative hedge funds

- Simple to apply to any existing investment strategy

- Remain fully invested as long as possible

- Disciplined approach that avoids behavioral bias pitfalls

- Reduced drawdowns and increased Sharpe Ratio

Potential drawback

- Reduced performance during sideway oscillating markets