Crypto Investing

Based on systematic hedge fund models, our crypto signals provide insights about when to enter the major cryptocurrencies. The goal is to identify behavioral trends that will help you capture the upside in crypto markets.

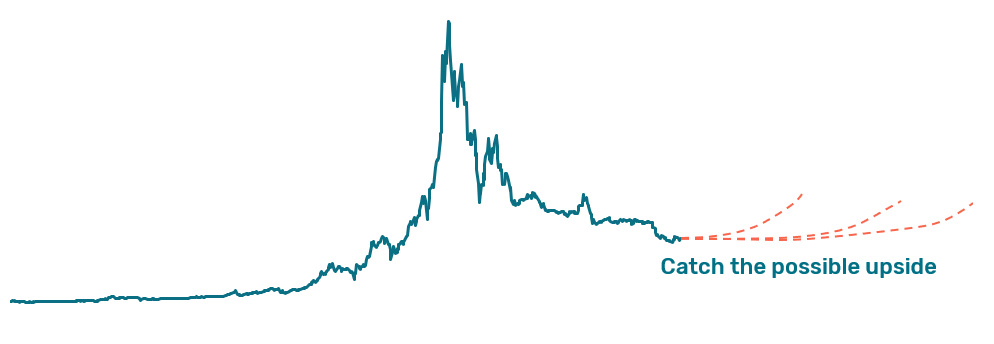

Cryptos are on the rise. People who once were skeptical are beginning to understand the technology behind and are starting to adopt cryptos as a new asset class. For traders and investors cryptos offer new opportunities. But crypto investments can be a rollercoaster ride. Crypto markets depend a good deal on market sentiment and investor behavior. To succeed in the digital asset space, you need the best information available, stay disciplined and avoid behavioral pitfalls. That is where Sanostro can assist. We offer systematic rule-based decision guidance of when to buy and sell cryptos. Our signal intelligence is sourced from leading systematic quant managers. You benefit from the insight of many top quant funds delivered to you as actionable trading signals.

Combine your crypto strategy with systematic crypto insights

For investors who believe that a crypto bull market is coming, but are in need of insights when to enter the market.

Benefits

- Crypto intelligence from top quantitative hedge funds

- Benefit from short term trends and market behavior

- Disciplined systematic approach avoids behavioral bias pitfalls

- Actionable trading signals

- Simple to apply to any existing trading or investment strategy